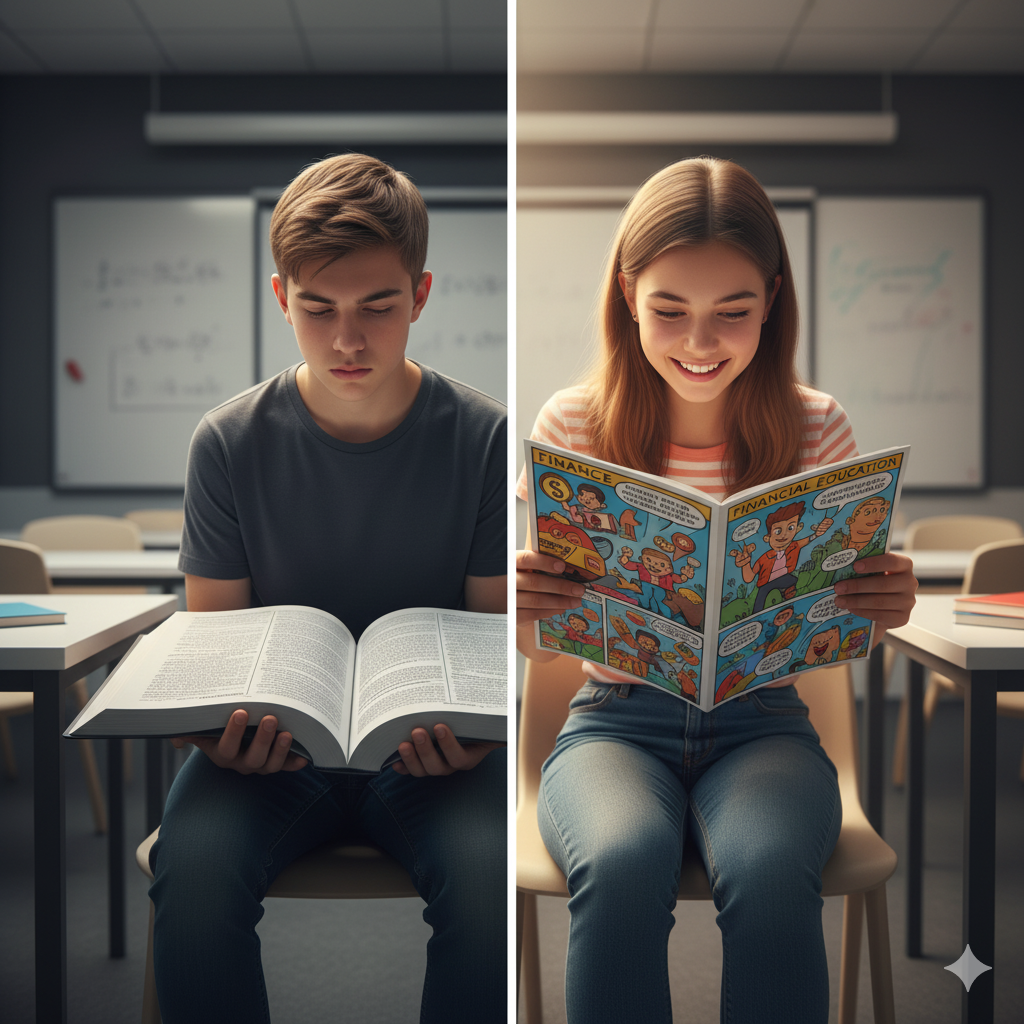

Why Comic-Based Financial Education Works Better Than Traditional Methods

Financial literacy education faces a fundamental challenge: traditional teaching methods fail to engage today’s visually-oriented learners, leaving 73% of teens unprepared for basic money management decisions. Research from the National Financial Educators Council reveals that students retain financial concepts 340% better when learned through visual storytelling versus textbook-based instruction.

The crisis in financial education runs deep. Despite financial literacy requirements in 23 states, only 57% of American adults are financially literate. Traditional approaches—worksheets, lectures, and hypothetical scenarios—disconnect from students’ daily digital experiences. This educational gap costs the average American $1,230 annually in preventable financial mistakes, according to the Financial Industry Regulatory Authority.

Comics revolutionize this learning landscape by combining visual processing with narrative engagement. The human brain processes visual information 60,000 times faster than text, making comic-based education naturally aligned with how students learn best. WhizToonz’s BizToonz series exemplifies this approach, following character Onya’s entrepreneurial journey while teaching essential financial concepts through engaging storylines.

The science behind comic-based financial learning

Educational psychology research demonstrates that dual coding theory—simultaneous visual and verbal information processing—significantly enhances memory retention. Dr. Allan Paivio’s groundbreaking work shows that students remember information better when it’s presented in multiple formats simultaneously.

Comic-based financial education leverages several cognitive advantages. Visual metaphors simplify complex concepts like compound interest, where illustrations can show money “growing” over time more effectively than numerical explanations. Sequential art naturally demonstrates cause-and-effect relationships, essential for understanding financial consequences. Character identification creates emotional investment in learning outcomes.

Successful implementation requires specific design principles. Effective educational comics balance entertainment with instruction, maintaining approximately 70% story engagement to 30% educational content. Characters should face realistic financial challenges that mirror students’ experiences. Visual design must support, not distract from, learning objectives.

Research by the Institute for Educational Sciences found that students using comic-based financial curriculum showed 23% higher test scores compared to traditional instruction groups. More importantly, these students demonstrated better practical application of financial concepts in simulated real-world scenarios.

WhizToonz’s approach addresses common financial literacy gaps systematically. The platform’s WhizBits digital currency system lets students practice money management in a safe environment. Students earn, spend, and save virtual currency while learning budgeting fundamentals through hands-on experience rather than abstract concepts.

Age-appropriate financial concepts through visual storytelling

Different age groups require tailored approaches to financial education. Elementary students (ages 7-10) benefit from basic concepts like earning, spending, and saving, illustrated through character adventures. WhizToonz introduces these fundamentals through Onya’s simple business ventures, showing how work creates income and wise choices preserve resources.

Middle school students (ages 11-13) can grasp more complex topics including budgeting, goal-setting, and basic investing principles. Comic narratives excel at showing long-term consequences of financial decisions. Students witness characters making budgeting mistakes and learning from failures, creating vicarious learning experiences that stick.

High school students (ages 14-18) need exposure to real-world financial systems including credit, loans, taxes, and investment strategies. Advanced storylines can explore entrepreneurship, digital currencies, and global economic concepts. WhizToonz’s integration of AI education with financial literacy prepares students for an economy where understanding both domains becomes increasingly important.

Critical thinking development occurs naturally through comic narratives. Students analyze character decisions, predict outcomes, and evaluate alternative approaches. This analytical engagement develops financial decision-making skills more effectively than passive instruction methods.

Addressing educator and parent concerns

Teachers often hesitate to use comic-based materials, questioning educational rigor. However, extensive research validates comics as legitimate educational tools. The Teacher Comics Toolkit study found that 89% of educators using comic-based instruction reported increased student engagement, while maintaining or improving learning outcomes.

Parents frequently worry about screen time and educational value. WhizToonz addresses these concerns through interactive features that require active participation rather than passive consumption. The platform’s progress tracking lets parents monitor learning advancement, while educational reports demonstrate skill development.

Implementation challenges include teacher training and curriculum alignment. Successful programs provide professional development for educators, showing how comic-based materials support existing learning objectives. WhizCentre’s educator resources include lesson plans, assessment tools, and implementation guides specifically designed for seamless classroom integration.

Budget constraints often limit educational technology adoption. WhizToonz’s global accessibility model addresses this concern through flexible pricing structures that accommodate diverse economic circumstances, ensuring financial education reaches students regardless of socioeconomic background.

Real-world application and skill transfer

The ultimate test of financial education effectiveness lies in real-world application. Comic-based learning excels at skill transfer because visual narratives create memorable mental models that students can reference when facing actual financial decisions.

Longitudinal studies show improved financial behaviors among comic-educated students. Participants demonstrate higher savings rates, better budgeting practices, and reduced susceptibility to predatory financial products. These outcomes persist years after initial instruction, indicating genuine skill acquisition rather than temporary knowledge retention.

WhizToonz enhances skill transfer through practical application opportunities. Students create business plans for Onya-inspired ventures, analyze real market trends, and make virtual investment decisions with tangible consequences. This experiential learning bridges the gap between theoretical knowledge and practical application.

Future of financial education through edutainment

The intersection of education and entertainment continues evolving as digital natives demand more engaging learning experiences. AI-powered personalization will customize comic narratives to individual student interests and learning styles, making financial education increasingly relevant and effective.

Emerging technologies like augmented reality could enhance comic-based instruction by allowing students to interact with financial scenarios directly. Virtual reality simulations might let students experience entrepreneurial challenges firsthand, creating deeper understanding of business and financial principles.

Global connectivity enables sharing successful financial education models across cultures and economies. WhizToonz’s multilingual approach recognizes that financial literacy challenges transcend national boundaries, requiring internationally applicable solutions delivered through universally appealing visual storytelling.

Conclusion

Comic-based financial education represents a paradigm shift from ineffective traditional methods to engaging, memorable instruction that actually changes student behavior. WhizToonz’s innovative combination of visual storytelling, practical application, and cross-curricular learning creates the comprehensive financial literacy foundation today’s students desperately need.

As the economy becomes increasingly complex and digital, preparing young people with both financial knowledge and practical skills becomes ever more critical. Through platforms like WhizToonz, we can ensure the next generation possesses the financial literacy necessary for economic success and personal wellbeing.

Ready to transform financial education at your school or home? Explore WhizToonz’s comprehensive edutainment platform and join the thousands of educators and parents already seeing remarkable results in student financial literacy development.